how to change how much taxes are taken out of paycheck

If you earn 50000 before taxes and you contribute 2000 of it to your 401 thats 2000 less youll be taxed on. So if you elect to save 10 of your income in your companys 401k plan 10 of your pay will.

Understanding Your Paycheck Stub Information Earnings Deductions How To Read Your Pay Stub Iris Fmp

Figure out your new withholding on through the IRSs tax withholding estimator.

. For those age 50 or older the limit is 27000 allowing for 6500 in catch-up contributions. This is a rough estimate of what your. In order to adjust your tax withholding you will have to complete a new W-4 form with your employer.

For 2022 the limit for 401 k plans is 20500. Filing tax exempt for one paycheck seems like a good way to raise quick cash but the IRS has qualifying requirements that discourage this practice. Its important to note that there are limits to the pre-tax contribution amounts.

The IRS encourages everyone including those who typically receive large refunds to do a Paycheck Checkup to make sure they have the right amount of tax taken out of their. Next add in how much federal income tax has already been withheld year to date. Take your new withholding amount per pay period and multiply it by the number of pay periods remaining in the year.

To fatten your paycheck and receive a smaller refund submit a new Form W-4 to your employer that more accurately reflects your tax situation and decreases your federal. If you prefer owing the IRS at years end rather than receiving a refund you may need to complete a new W-4 form to change the tax that your employer withholds from your. Form W-4 tells your employer how much tax to withhold from your paycheck.

Your employer is required. Get a new W-4 Form and fill it out completely based on your situation. This total represents approximately how much total federal tax will be withheld from your paycheck for the year.

Submit your new W-4 to. Taxpayers can use the updated Withholding Calculator on IRSgov to do a quick paycheck checkup to check that theyre not having too little or too much tax withheld at work. For the first 20 pay periods therefore the total FICA tax withholding is equal to or.

Only the very last 1475 you earned. An example of how this works. Use our W-4 calculator and see how to fill out a 2022 Form W-4 to change withholdings.

You can ask your employer for a copy of this form or you can obtain it. For a single filer the first 9875 you earn is taxed at 10. The next 30249 you earn--the amount from 9876 to 40125--is taxed at 15.

The most common pre-tax contributions are for retirement accounts such as a 401k or 403b. To figure out the yearly amount take the new amount withheld per pay period and multiply it by the number of remaining pay periods. Since 142800 divided by 6885 is 207 this threshold is reached after the 21st paycheck.

When you file your tax return youd.

Different Types Of Payroll Deductions Gusto

How To Calculate Take Home Pay As A Percentage Of Gross Pay The Motley Fool

Check Your Paycheck News Congressman Daniel Webster

What Are Payroll Deductions Article

:max_bytes(150000):strip_icc()/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

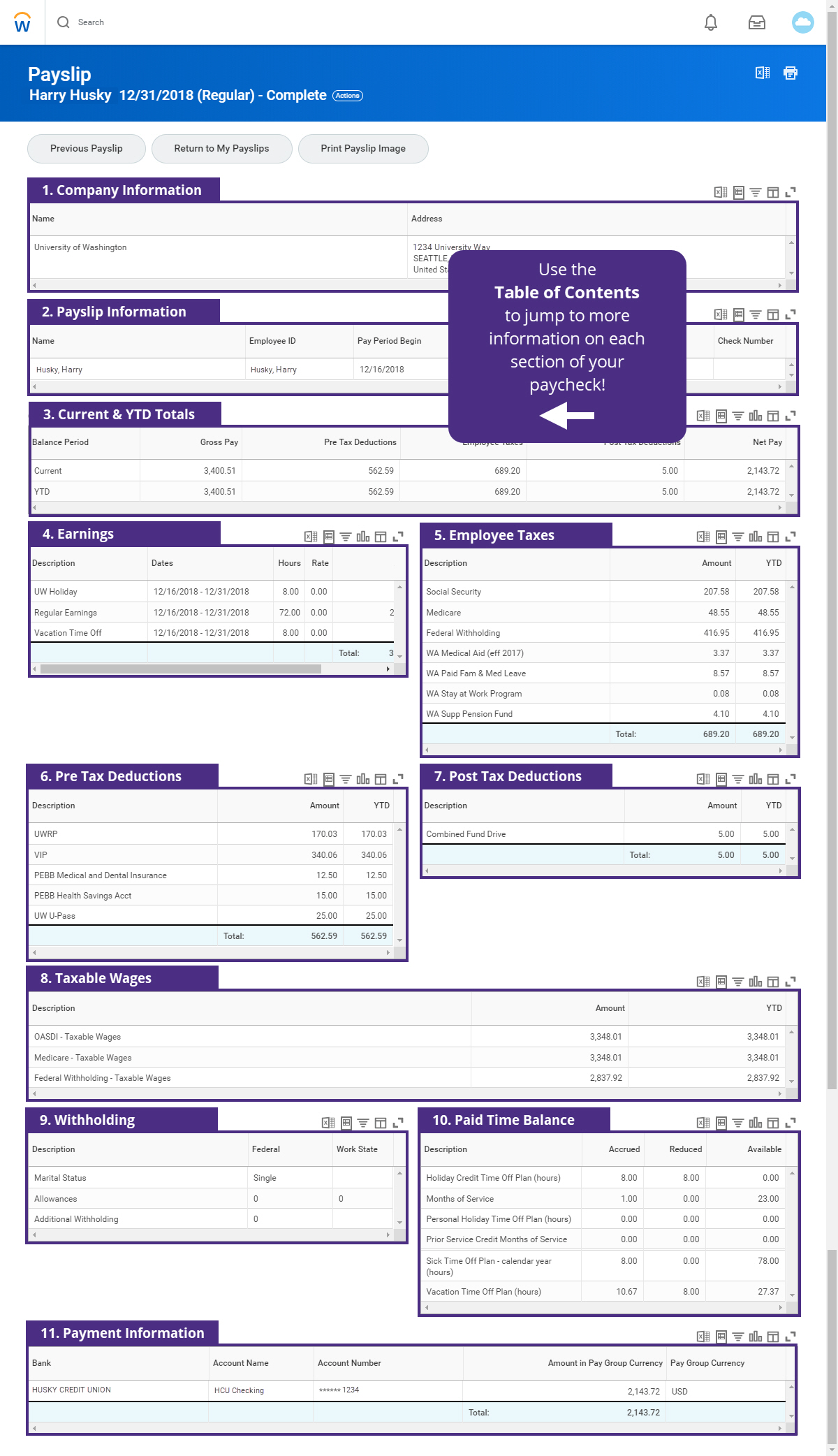

How To Read Your Payslip Integrated Service Center

:max_bytes(150000):strip_icc()/Paycheck_AdobeStock_154492502_Editorial_Use_Only-b62ac70013ec4e13b3e2a73be5e9c239.jpeg)

Annual Compensation Vs Annual Salary

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Here S How Much Money You Take Home From A 75 000 Salary

Important Tax Information Work Travel Usa Interexchange

Paycheck Taxes Federal State Local Withholding H R Block

How To Adjust Your Tax Withholding For A Larger Paycheck Mybanktracker

Paycheck Calculator Online For Per Pay Period Create W 4

Is Federal Tax Not Withheld If A Paycheck Is Too Small Quora

How To Calculate Taxes Using A Paycheck Stub The Motley Fool