iowa state income tax calculator 2019

After a few seconds you will be provided with a full breakdown of the tax you are paying. Find your pretax deductions including 401K flexible account contributions.

How To Calculate Federal Income Taxes Social Security Medicare Included Youtube

Blank Forms PDF Forms Printable Forms Fillable Forms.

/Clipboard01-f1d6a5bc55844d8a9e488506939e560a.jpg)

. Subtract line 2 from line 1. Find your income exemptions. 2019 income tax estimator.

Ad Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. Simply select your tax filing status and enter a few other details to estimate your total taxes. About Iowa income tax withholding.

Ad Enter Your Tax Information. If line 66 is less than line 58 subtract line 66 from line 58 and enter the difference. ICalculator aims to make calculating your Federal and State taxes and Medicare as simple as.

Find your gross income. Interest is not charged on penalty. How to calculate Federal Tax based on your Annual Income.

1040EZ Tax Form Calculator. Fields notated with are required. To use our Iowa Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button.

In addition to the exemption provisions above if you were a nonresident or part-year resident and had net income from Iowa sources of less than 1000 see note below you are exempt from Iowa tax. This breakdown will include how much income tax you are paying state taxes federal taxes and many other costs. Enter other state and local income taxes not including Iowa state income taxes on line 4a OR general sales taxes on line 4b as allowed on the federal form 1040 Schedule A line 5a.

Status 3 and 4 filers. The median household income is 58570 2017. To review instructions for Iowa-source income see the instructions for lines 1-26 of the IA 126.

The Iowa State Tax Calculator IAS Tax Calculator uses the latest Federal tax tables and State Tax tables for 202223To estimate your tax return for 202223 please select the 2022 tax year. See What Credits and Deductions Apply to You. The state-level income tax rate ranges from 033 to 853 and residents of Appanoose county need to pay 1 local income tax.

The 1040EZ is a simplified form used by the IRS for income taxpayers that do not require the complexity of the full 1040 tax form. This means that your income is split into multiple brackets where lower brackets are taxed at lower rates and higher brackets are taxed at higher rates. For tax year 2019 the standard deduction is.

You may file a new IA W-4 with your employer to change the amount of Iowa income tax withheld from your pay. Income subject to alternate tax calculation. The state income tax system in Iowa is a progressive tax system.

State Tax Tables for 2019 displayed on this page are provided in. These types of capital gains are taxed at 28 28 and 25 respectively unless your ordinary income tax bracket is a lower rate. Multiply line 3 by 853 0853.

Calculate tax separately and combine the amounts 5. If the amount you owe line 70 is large you may wish to check the Withholding Calculator to estimate your recommended withholding. Long-term Capital Gain Tax Rates 2022.

Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes. Certain circumstances may cause the amount of Iowa withholding tax calculated by the withholding calculator to differ from a. Check the 2019 Iowa state tax rate and the rules to calculate state income tax.

Based on your projected tax withholding for the year we then show you your refund or. You must calculate interest on the 500 and add it to the 550. Compare your take home after tax and estimate your tax return online great for single filers married filing jointly head of household and widower.

If you make 70000 a year living in the region of Iowa USA you will be taxed 14177. If you would like to update your Iowa withholding amount file the 2022 IA W-4 44-019 form with your employer. The tax brackets are the same regardless of your filing status and tax rates range from 033 to 853.

The 2019 Tax Calculator uses the 2019 Federal Tax Tables and 2019 Federal Tax Tables you can view the latest tax tables and historical tax tables used in our tax and salary calculators here. Your average tax rate is 1198 and your marginal tax. 2019 IA 1040 TAX TABLES For All Filing Statuses To find your tax.

There is also additional. Iowa Income Tax Calculator 2021. Your total unpaid tax and penalty is now 550.

Easily Download Print Forms From. 2019 Iowa Tax Tables with 2022 Federal income tax rates medicare rate FICA and supporting tax and withholdings calculator. How to Calculate 2019 Iowa State Income Tax by Using State Income Tax Table.

Additional withholding cannot exceed your taxable wages less your federal withholding for a pay period. Download or Email IA 1040 More Fillable Forms Register and Subscribe Now. This calculator assumes that none of your long-term capital gains come from collectibles section 1202 gains or un-recaptured 1250 gains.

If you filed your return on time but did not pay at least 90 of the correct tax due by the due date you owe an additional 5 of the unpaid tax. Iowa Paycheck Calculator. If you had Iowa tax withheld and are requesting.

Using the tax tables determine the tax on the taxable income from line 38 of the IA 1040. You can quickly estimate your Iowa State Tax and Federal Tax by selecting the tax year your filing status Gross Income and Gross Expenses this is a great way to compare salaries in Iowa and. Compare the amounts on line 4 and line 5.

Read down the left column until you find the range for your Iowa taxable income from line 38 on form IA 1040. Read across to the column marked Your Tax Is Enter the amount on line 39. Your total tax liability for the year is 2000.

For 2022 tax year. Ad 2019 income tax estimator. Iowa has a population of over 3 million 2019 and is the leading producer of corn in the world second to China.

Ad Estimate Your Taxes and Refunds Easily With This Free Tax Calculator from AARP.

All About F1 Student Opt Tax F1 Visa Tax Exemption Tax Return

Is Social Security Taxable Estimated Tax Payments Social Security Income

Reciprocal Agreements By State What Is Tax Reciprocity

County Surcharge On General Excise And Use Tax Department Of Taxation

Do I Have To File State Taxes H R Block

Iowa Income Tax Calculator Smartasset

2019 State Income Tax Rates Credit Karma

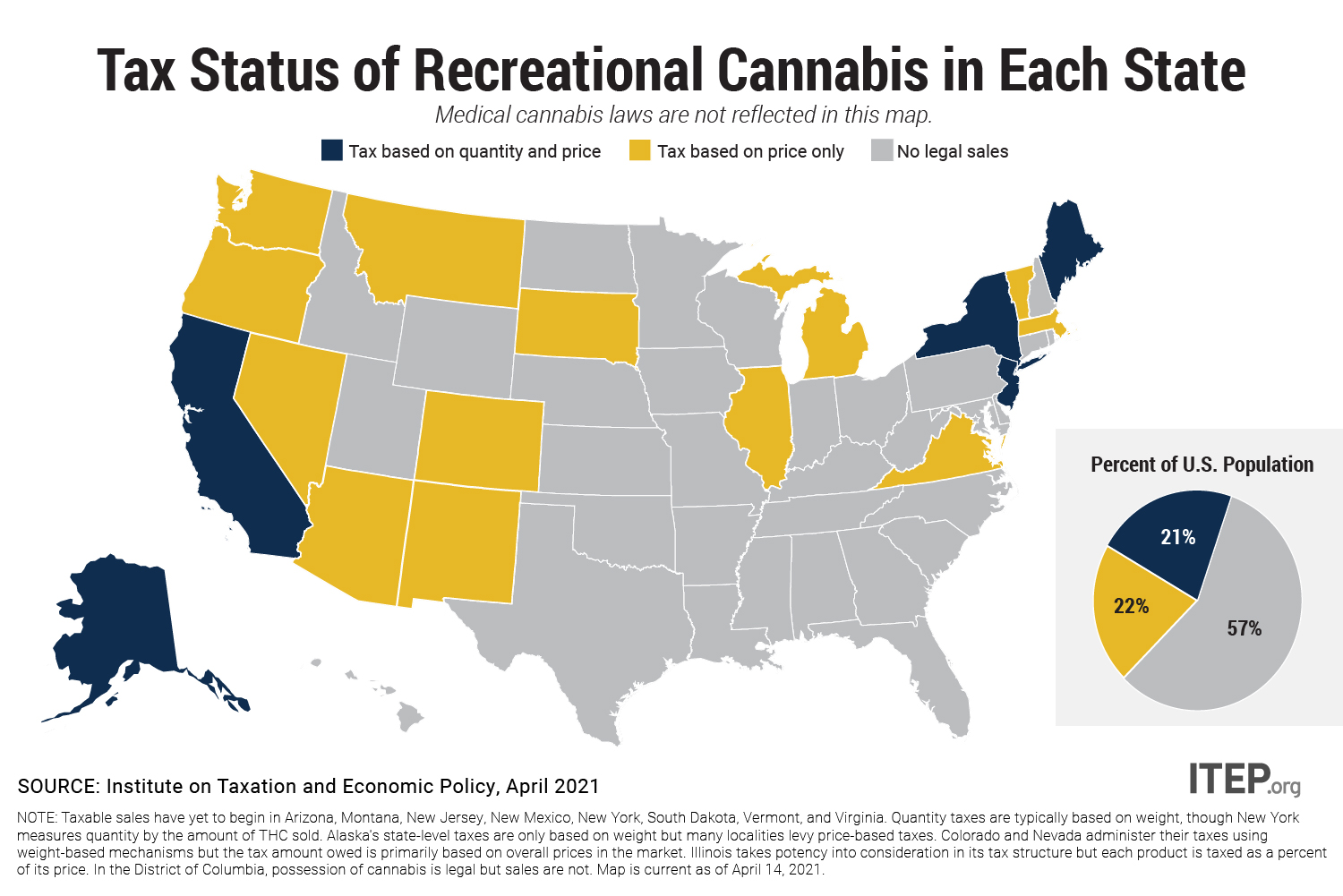

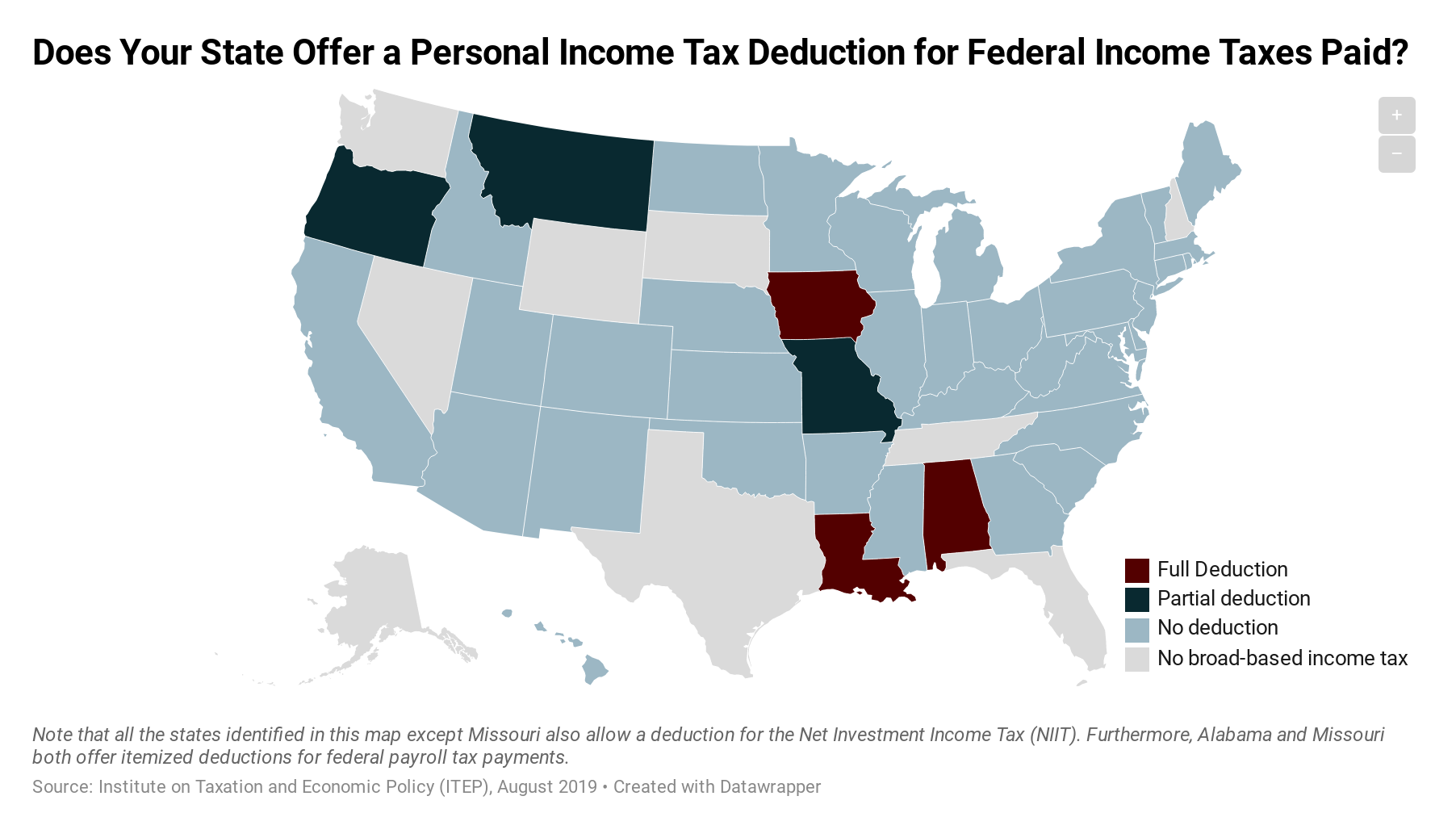

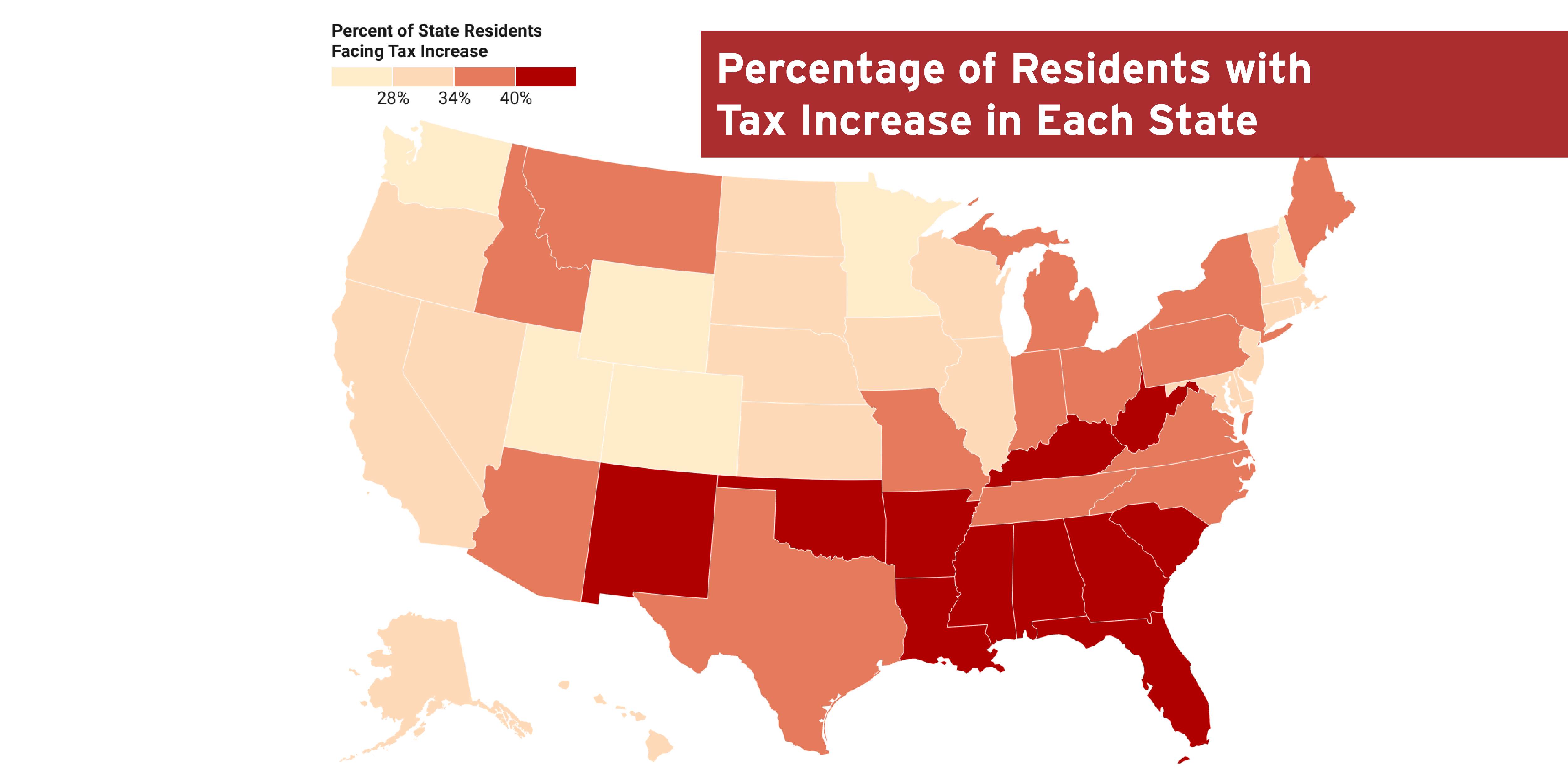

How The Tcja Tax Law Affects Your Personal Finances

Do I Need An Out Of State Attorney Dads Divorce Child Custody Spring Break Idioms

How The Tcja Tax Law Affects Your Personal Finances

How The Tcja Tax Law Affects Your Personal Finances

License Requirements By State Polaris Slingshot

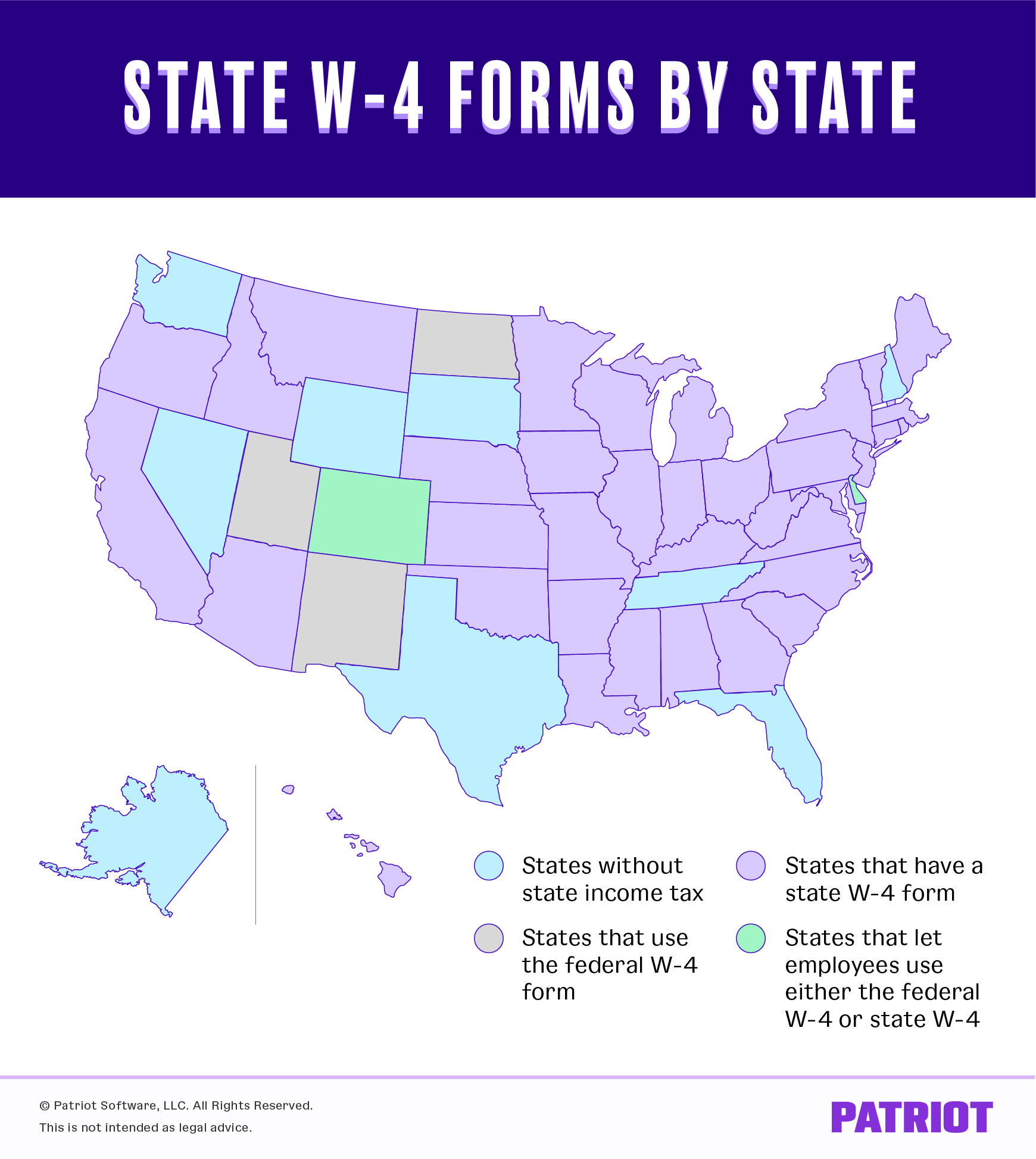

State W 4 Form Detailed Withholding Forms By State Chart

I Live In One State Work In Another Where Do I Pay Taxes Picnic S Blog